There’s a great deal of buzz regarding the Inflation Reduction Act of 2022 (the “IRA”)—a bill that was signed by President Biden in August 2022. But what does the IRA mean for you and your family? It means you can save money!

Understanding the New Law

The Inflation Reduction Act helps reduce energy costs and reduces the financial impact of home improvements, among other things. The IRA offers rebates and tax credits, allowing homeowners to save thousands of dollars when they purchase a qualifying high-efficiency HVAC system, heat pump, insulation, or water heater upgrade.

Eligible Home Products

The Inflation Reduction Act (IRA) includes a variety of tax credits for home products that can be used to reduce energy consumption and costs. Some examples of eligible home products for IRA tax credits include:

-

Heat pumps for heating and cooling

-

Water heaters

-

Biomass stoves

-

Advanced main air circulating fans

-

Insulation

-

Heat Pumps

-

Natural gas, propane, or oil furnace or hot water boiler with an AFUE of at least 95

-

Certain types of air-source and ground-source heat pumps

-

Certain types of biomass-fueled boilers, and certain types of circulating fans for natural gas furnaces

Tax Credit Qualifications

The Inflation Reduction Act provides a federal tax credit for homeowners who make energy-efficient improvements to their home. This tax credit is a non-refundable credit, meaning that the homeowner must have a tax liability in the year the credit applies in order to take advantage of the credit. It is important to note that this credit is only available for work done on the homeowner's principal residence.

This tax credit is a great opportunity for homeowners to save money while also making their homes more energy efficient. However, it is important to consult with a licensed tax professional prior to beginning any work in order to ensure that the equipment or work qualifies for the credit. A tax professional can help the homeowner understand the specific qualifications and requirements under the IRA and can provide guidance on the best way to maximize the credit.

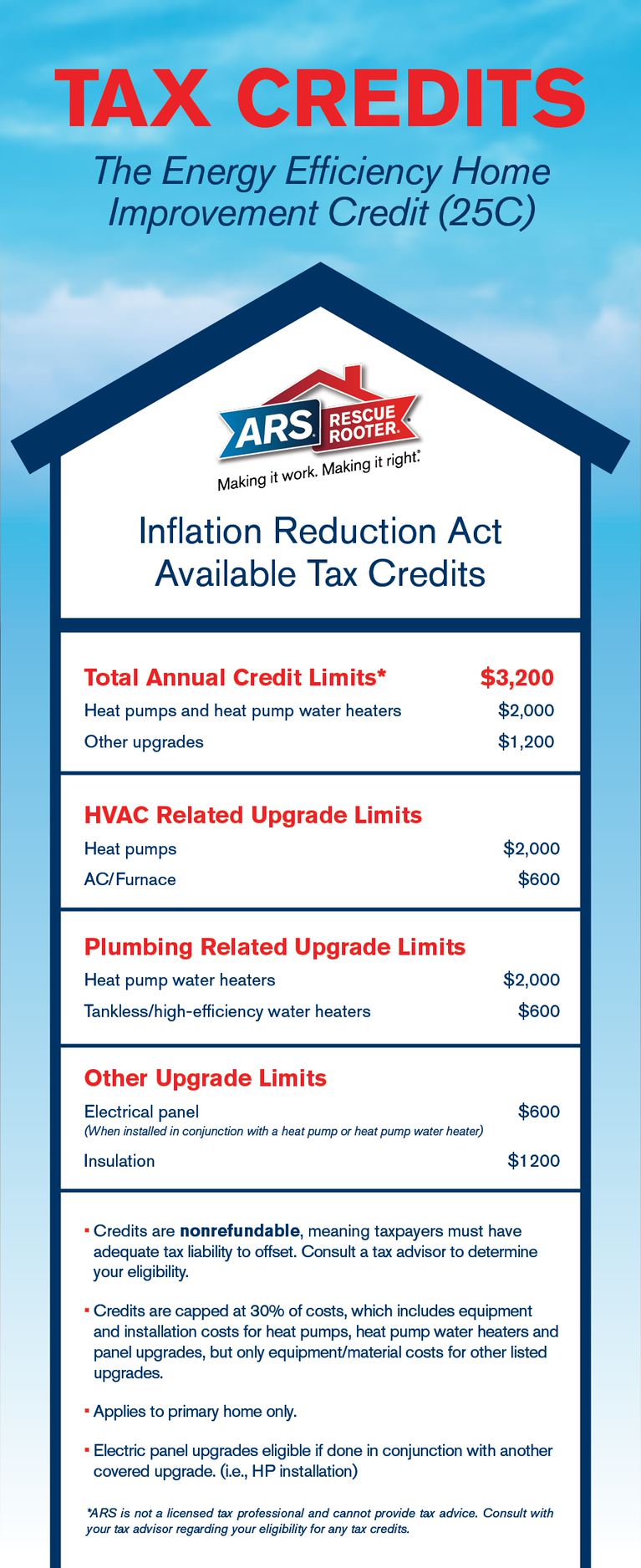

Tax Credit Information

Tax credits are available for home improvements that include the installation of energy-efficient heat pumps, heat pump water heaters, geothermal heating installation, and insulation improvements. Beginning January 1, 2023, homeowners may be eligible for up to $2,000 in annual tax credits under the IRA through 2032. Check out this infographic for more information about tax credit limits on eligible equipment.

ARS is not a licensed tax professional and cannot provide tax advice. We recommend consulting with your tax advisor on eligibility for any tax credits.

Household Savings

1. Heat Pumps: Tax Credit of 30% with an annual cap of $2,000.

2. Air Conditioning: Tax Credit of 30% with an annual cap of $1,200.

3. Insulation: Tax Credit of 30% with an annual cap of $1,200.

4. Windows and Doors: Tax Credit of 30% with an annual cap of $1,200.

5. Water Heaters: Tax Credit of 30% with an annual cap of $1,200.

6. Biomass Stoves: Tax Credit of 30% with an annual cap of $300.

7. Geothermal Heat Pumps: Tax Credit of 30% with an annual cap of $2,000.

What is a Heat Pump?

In milder climates where temperatures don’t typically dip below 25 degrees, many homeowners rely on heat pumps as a means of heating and cooling their homes. This energy-efficient, reliable system is called a “heat pump” because its main job is to transfer heat in or out of your home, depending on the season. For example, in the summer, your heat pump will push warm air from the inside to the outside to keep your indoors cool. Then in the winter season, it transfers air from outside and warms it, so you stay super snug.

ARS®/Rescue Rooter® Reviews

See what our customers have to say about us